- Home

- Insurance Agent

- Pennsylvania

- Wexford

- Roy Turner

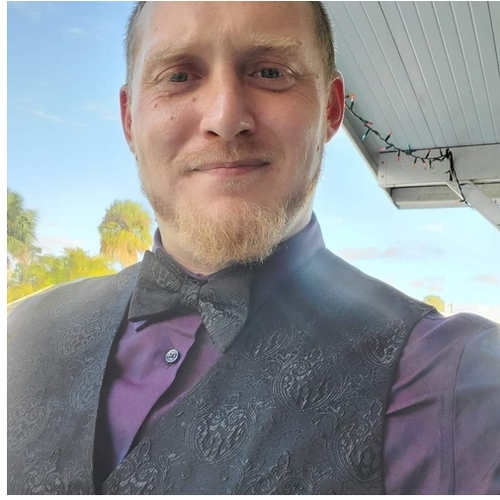

Roy Turner

Comparion Sales Agent | Wexford, PA

Quote with Roy

About me

Comprehensive Insurance Solutions in Southwestern Pennsylvania

Finding the right insurance coverage is essential for protecting your assets and ensuring peace of mind. In Southwestern Pennsylvania, including major cities like Greensburg, Pittsburgh, Washington, Cranberry, South Hills, Irwin, Jeannette, New Kensington, and Harmarville, understanding your insurance options can help you make informed decisions. This article provides a detailed overview of various types of insurance, including car insurance, home insurance, specialized policies, and advice for selecting the right insurers.

Car Insurance in Pittsburgh and Surrounding Areas

Car insurance is crucial for every vehicle owner in Southwestern PA. Whether you're navigating the busy streets of Pittsburgh or enjoying the quieter roads of Greensburg or Irwin, adequate car insurance protects you from unexpected incidents. When selecting a policy, consider factors like liability coverage, collision, comprehensive options, and the specific driving conditions in your area.

Home Insurance for Pittsburgh Residents

Home insurance protects your property from unforeseen damages, such as fire, theft, and natural disasters. For residents in cities like Cranberry and Washington, understanding home insurance is vital for safeguarding your investment. Evaluate your home's value, personal belongings, and any potential hazards in your region to select a policy that meets your needs.

Umbrella Insurance: An Extra Layer of Protection

Umbrella insurance provides additional liability coverage beyond your existing policies, such as car or home insurance. This extra layer of protection is essential for homeowners and business owners in cities like New Kensington and Jeannette, where accidents can lead to significant financial claims. Umbrella insurance helps protect your assets and future earnings from lawsuits.

Life Insurance: Securing Your Loved Ones' Future

Life insurance is a fundamental aspect of financial planning for residents of all ages in Southwestern PA. Whether you live in South Hills or Harmarville, having life insurance ensures your loved ones are financially secure if anything happens to you. Types of life insurance include term and whole life policies, and it’s important to assess your financial goals and family needs when choosing coverage.

Insurance Consulting Services

Navigating the complexities of insurance can be challenging. Insurance consulting services are available in cities like Cranberry and Greensburg, providing personalized advice on selecting the best policies for your specific needs. These professionals can guide you through options like car insurance, home insurance, and specialized coverages, ensuring you make informed decisions that protect your interests.

Specialized Insurance: Boat and ATV Coverage

Outdoor enthusiasts in Southwestern PA often seek specialized coverage for their recreational vehicles. If you own a boat or ATV, ensuring you have the right insurance is crucial. Boat insurance protects your watercraft from damage and liability while enjoying the beautiful waterways in the region. Meanwhile, ATV insurance covers off-road vehicles against accidents and theft, particularly important for recreational areas around Greensburg and Irwin.

Classic Car Insurance for Collectors

Classic car owners in Pittsburgh and nearby cities need specialized classic car insurance to protect their investments. This coverage safeguards vintage vehicles against accidents, theft, and other damages, often providing agreed value coverage that ensures you receive the full value of your car in case of a loss. Consulting with an insurance professional can help you find the best classic car policy tailored to your needs.

Condo and Renters Insurance in Southwestern PA

Whether you own a condo in the heart of Pittsburgh or rent an apartment in South Hills, having appropriate insurance is essential. Condo insurance protects your unit and personal belongings, while renters insurance provides coverage for personal property in a rental situation. Both types of policies often include liability coverage, giving you peace of mind while residing in these communities.

E-Bike and Golf Cart Insurance

As e-bikes and golf carts become increasingly popular in areas like Cranberry and Harmarville, specialized insurance for these vehicles is essential. E-bike insurance typically covers theft, damage, and liability, allowing you to ride confidently. Similarly, golf cart insurance protects your vehicle whether you’re cruising the course or navigating your neighborhood.

Jet Ski and Watercraft Insurance

With numerous lakes and waterways in Southwestern PA, jet skiing is a favored summer pastime. Jet ski insurance is vital for protecting your watercraft from damages and liability claims while enjoying leisure time on the water. Watercraft insurance also encompasses various types of boats, ensuring comprehensive coverage whether you’re storing your vessel during the off-season or enjoying a day on the lake.

Jewelry Insurance for High-Value Items

For residents with valuable jewelry in Pittsburgh or other towns in the region, jewelry insurance is a wise investment. Standard homeowners insurance may not fully cover the value of your jewelry, making specialized coverage a necessity. This policy protects against theft, loss, and damage, ensuring your treasured items are safeguarded.

Landlord Insurance in Southwestern PA

If you’re a landlord in cities like Washington or Jeannette, landlord insurance is critical for protecting your rental property. This type of insurance covers damages to the property, liability claims, and loss of rental income. Tailoring your policy to fit your specific needs is essential, especially in rental markets that vary across communities.

Small Business Insurance for Entrepreneurs

Entrepreneurs in cities like Greensburg and New Kensington require small business insurance to protect their investments. This insurance typically includes general liability, property insurance, and workers’ compensation. Partnering with an insurance consultant can help you navigate the complexities of business insurance and ensure your policy fits your unique requirements.

Motorcycle and ATV Insurance for Riders

Motorcycle insurance is essential for motorcycle enthusiasts throughout Southwestern PA. This type of coverage is crucial for protecting yourself on the road, offering liability, collision, and comprehensive options. Likewise, ATV insurance provides coverage for your off-road adventures, particularly in rural areas around Irwin and Jeannette.

Pet Insurance for Animal Lovers

Pet owners in the Pittsburgh area can benefit from pet insurance, which helps cover unexpected veterinary expenses. As veterinary bills can quickly accumulate, pet insurance provides financial assistance for your furry friends’ medical needs, allowing you to focus on their health without financial stress.

Vacation Rental Insurance

As short-term rentals grow in popularity in cities like Pittsburgh, Greensburg, and Cranberry, vacation rental insurance is becoming increasingly important. This coverage protects property owners from liability claims, property damage, and loss of rental income. Securing vacation rental insurance is a must for anyone renting out their property in Southwestern PA.

Comprehensive Coverage: Smart Devices and Annuities

In our tech-driven world, smartphone and device insurance is essential. This coverage protects your valuable electronics from loss or damage, providing peace of mind for residents across the region. Additionally, discussing annuities with a financial advisor can secure your financial future and help provide income replacement during retirement.

Conclusion

In Southwestern Pennsylvania, from the bustling city life in Pittsburgh to the quaint towns of Greensburg, Washington, and beyond, understanding your insurance options is crucial for protecting your assets and ensuring financial security. Whether you require car insurance, home insurance, life insurance, or specialized coverage for recreational vehicles, having the right policy in place can make all the difference. Engage with an insurance consulting service to navigate the complexities of selecting coverage limits and ensuring proper asset protection. By making informed decisions, you can safeguard your future and enjoy peace of mind in your community. - This content was generated by LibertyGPT and should be reviewed for accuracy.

Licensed in

Pennsylvania - 880001

Services

Car insurance

Home insurance

Umbrella insurance

Life insurance

Insurance consulting

Languages

English